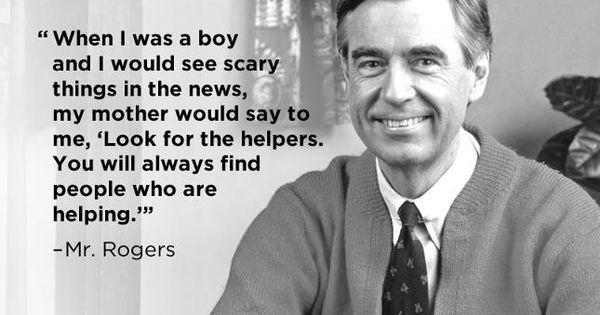

Mr. Rogers said his mother told him to "look for the helpers" during scary times. We are all facing an unprecedented upheaval to our lives - personal and business - and it is incredible how our family business and service provider members are stepping up to help.

We're going to use this space to highlight those helpers and will update frequently.

We will also be posting webinar links and other family business content on Facebook and LinkedIn, so be sure to follow us there, too.

Family-Owned Business Helpers

From GO-HR:

The CARES Act was signed late last week and many small businesses and their partners are combing through it to understand how to access various relief options. I reached out to my business bankers who shared with me that the business banking arm of their organization does not anticipate being able to work with their business clients until the SBA finalizes the loans and terms that will be offered. They’re projecting end of this week at the earliest.

- Reach out to your bank NOW and ask them to put you on their follow up list to be contacted as soon as terms are finalized.

- Talk with your accountant/CFO to understand the best strategy for NOW AND LATER for your business and your business’s unique needs regarding the various components of the CARES Act and its interplay with any disaster loan or grants you may already have, any filing extensions, etc.

Talk to your health insurance people. If you have an HSA or FSA, there is an expansion of items (such as over-the-counter meds and personal hygiene products) that employees can submit through their accounts for reimbursement.

Talk to your financial advisors about the hardship withdrawal options employees can take from their retirement accounts.

As you review the Paycheck Protection Program Loans, consider this. If you keep your workforce on payroll – even if work has slowed down to a trickle – is this a good time to invest in upskilling them or working on professional development options so that your team comes back stronger and ready to dig in once we’re on the other side of this? I have already started to hear that the dollars from the unemployment portion of the stimulus may create more money on unemployment for someone than if they worked, and that may be tough to argue with, but that won’t be the case for every employer or every employee.

Here are some helpful links, which we have also added to our update page at https://www.go-hr.biz/covid-19

- CARES Act: https://www.documentcloud.org/documents/6819239-FINAL-FINAL-CARES-ACT.html

- Stimulus Check Calculator (for employees): https://www.kiplinger.com/tool/taxes/T023-S001-stimulus-check-calculator-2020/index.php?utm_source=SYN-yahoo&utm_medium=referral&rid=SYN-yahoo&fbclid=IwAR2nzHHmsD7ZQnMOLOc9v7amvLMakknLCcymZeKTz96tVSfdGHVtriN3PKQ

- NAWBO Small Business Owner’s Guide: https://www.nawbo.org/sites/nawbo/files/The%20Small%20Business%20Owner%E2%80%99s%20Guide%20to%20the%20CARES%20Act_0.pdf?fbclid=IwAR3BqqF7TS_Q7O3aBE8ehZ4M-KmbDVcwrNhR3I0YXXaltL0lJXUxKCZzb9c

- NPR overview of Act: https://www.npr.org/2020/03/25/818881845/senate-reaches-historic-deal-on-2t-coronavirus-economic-rescue-package

- Fortune overview of Act: https://fortune.com/2020/03/27/coronavirus-unemployment-benefits-stimulus-package-who-eligible-when-start-how-much-long-faq-relief-bill/?fbclid=IwAR23Zv36AUVZ7SmJXWy-2T64PYGGHW3RujqldTW71PwKJYbeHjWtx-p1PVY

Ongoing

At Loquantur, we are doing our part to help keep the wheels of business moving... We are announcing a plan to provide affected businesses with resources to facilitate work from home and social distancing initiatives.

First, you can receive, at no charge, an 8 week subscription to our conferencing bridgehead. This will help you conduct office meetings with remote users.

Second, if your phone system is unable to handle it, we are offering an 8 week low cost Automated Answering system, that can distribute calls by extension to staffs' home or cell phones. Alternatively, if you need phones we can provide low cost home or office phones for those 8 weeks.

We're all in this together... Hopefully we can help your business remain OPEN for BUSINESS.

Please inquire by sending us a private message or call +1-800-527-9022 and ask for John.

We're offering free environmental, health and safety program reviews to make life a little easier. Let us ease the burden so you can focus on the rest of your job.

From now until April 3, we'll review your EHS programs for FREE. Just upload your programs via this link. That's it. And hopefully that's one less thing you need to worry about.

Free Program Review - Upload Now

We are offering Home Wine Delivery within a 10 mile radius of 270. (Not all heroes wear capes, friends! lol)

---

Service Provider Helpers

Our Service Providers are here for our members! Below are just a few ways they are continuing to provide resources. Please reach out to any of our Service Provider members if you have questions or need help. This list will be updated regularly, so be sure to check back soon!

Rea & Associates COVID-19 Resource Center

Nonprofit organizations in Franklin County who have been directly affected and are responding to the spread of COVID-19 in the community can apply for financial help.

---

Community Helpers

*Updated - Center for Change Management

Topic: Dealing With The Complexities of Covid-19: Frame the Situation Properly

Time: Apr 2, 2020 10:30 AM Eastern Time (US and Canada)

Join Zoom Meeting

Meeting ID: 271 325 604

The Columbus Chamber of Commerce

The SBA Disaster Loan Assistance application process is now available online. Please visit disasterloan.sba.gov to create your account and complete your application. For COVID-19 related declarations, please select “Economic Injury” when asked about your business losses during the application process. Once your application is submitted, you will also be able to check the application status by logging into your account. Please visit the Economic Injury Disaster Loans (EIDL) page for details, including guidance for eligibility.

Please note, the SBA Disaster Loan site is experiencing high traffic and may be over bandwidth from time to time causing error messages.

We also encourage you to reach out to your financial institution to discuss options. Federal regulators have loosened restrictions on banks providing more flexibility to respond to the needs of small businesses during this time.

More updates from our VP of Government Relations, Holly Gross, can be found here. The team is updating this as soon as new information is discovered.

Like many of you, I suddenly have an unusually clear calendar because most of my meetings have been postponed while everybody figures out a temporarily-new-normal. If you're feeling anxious because of all the uncertainty right now, you're not alone. So if you need help, I'm offering free 60-minute coaching sessions (over the phone, naturally!) for the next couple of weeks. No strings attached. Here is the link to grab a time on my calendar: https://lnkd.in/e4rkYvH

---

How are you helping? Let us know of other helpers and we'll get the word out! info@familybusinesscenter.com

Stay well.