It is not uncommon for closely-held businesses to purchase life insurance policies on its owners to fund a Buy-Sell Agreement, which provides for the company’s redemption of a deceased owner’s interests upon the death of an owner, commonly known as Key Person Insurance. However, the recent decision in Connelly v. United States should encourage owners of closely held businesses to take pause and evaluate the unexpected federal estate tax consequences which Key Person Insurance could have for the deceased owner’s next-of-kin.

The Supreme Court held that a corporation’s contractual obligation to redeem shares is not necessarily a liability that reduces a corporation’s value for purposes of the federal estate tax. Connelly v. United States, Dep’t of Treasury, IRS, 70 F.4th 412 (8th Cir. 2024). In other words, to accurately value a deceased owner’s interests, Key Person Insurance proceeds must be counted in a company’s valuation for the purposes of federal estate tax. Id. at 5. This decision will make succession planning more difficult for closely-held companies. Syllabus to Id. at 3. However, one solution to these complications is for owners to use cross-purchase agreements to provide for the repurchase of a deceased owner’s interests upon the death of an owner, so owners can ensure life-insurance proceeds are not includable in a company’s valuation, and thus an owner’s taxable estate, upon the death of an owner. Connelly, 70 F.4th at 8.

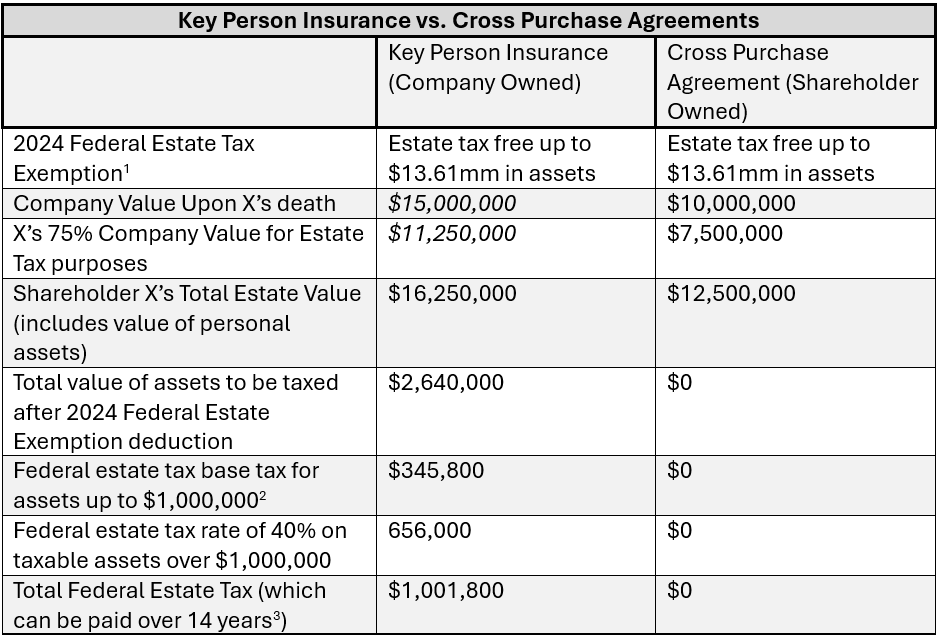

For illustrative purposes, Company ABC (“Company”) is a closely held corporation with two shareholders. Shareholder X (“X”) owns 75% of the shares. Shareholder Y (“Y”) owns 25% of the shares. X and Y executed a Buy-Sell Agreement with the Company in which upon the death of a shareholder, the Company shall redeem the deceased shareholder’s shares. Additionally, a valuation effective December 31, 2023, determined the value of the Company to be $10,000,000. The Company owns Key Person Insurance on X for $5,000,000 and on Y for $1,670,000. X passed away on July 7, 2024. X was unmarried at the time of her death, and in addition to her ownership in the Company she owned $3,000,000 in personal assets. The following chart illustrates a comparison of federal estate tax consequences between a $5,000,000 policy held through Key Person Insurance versus a $5,000,000 paid individually to the surviving shareholder, which would fund Cross Purchase Agreements between the Shareholders:

By having shareholders purchase life insurance policies on other shareholders and execute cross-purchase agreements in order to use those proceeds to fund a purchase upon the death of a shareholder, the proceeds from said policies will not be included in the valuation of the business for purposes of the deceased owner’s federal taxable estate. However, if closely held businesses continue to own Key Person Insurance on their shareholders/members, this could leave the estates and families of the deceased in a difficult position of paying estate taxes on assets that their loved ones will never actually receive.[4] It is also worth noting that the current federal estate tax exemption is scheduled to expire on December 31, 2025, and revert back to pre-2017 levels (adjusted for inflation). If Congress does not act to extend the exemption or make it permanent, the exemption will revert to between $6 million to $7 million per person.

If you are in a situation where you believe executing cross purchase agreements could be beneficial, you should consult with your corporate attorney to discuss the benefits and risks of executing cross purchase agreements, instead of buy-sell or redemption agreements, to fund buyouts related to the death of a shareholder/member.

[1] Estate tax. Internal Revenue Service. (n.d.-a). https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

[2] A guide to the federal estate tax for 2024. (n.d.). https://smartasset.com/taxes/all-about-the-estate-tax

[3] Legal Information Institute. (n.d.). 26 U.S. Code § 6166 - extension of time for payment of estate tax where estate consists largely of interest in closely held business. Legal Information Institute. https://www.law.cornell.edu/uscode/text/26/6166

[4] Supreme Court decision in Connelly v. United States alters estate tax treatment of corporate-owned life insurance proceeds. Supreme Court Decision in Connelly v. United States | Lewis Roca: Lewis Roca. (2024, June 6). https://www.lewisroca.com/alert-Supreme-Court-Decision-in-Connelly-v-United-States.

Thank you to our friends at Emens, Wolper, Jacobs, & Jasin for providing this valuable information.

If you are interested in being featured on our Family Business Insights or have any questions please contact lflint@familybusinesscenter.com